Foreword

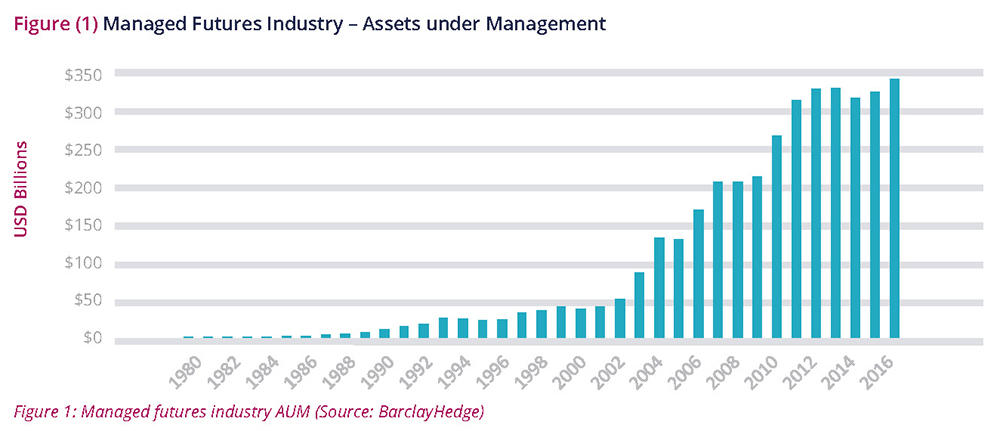

Managed futures funds have been the source of significant interest among investors, particularly since the sector outperformed so spectacularly during the global financial crisis. Since the crisis, allocations have increased – growing from a little over $200bn at the end of 2008 to around $340bn by the end of 2016.

There will always be caution among some investors, of course. Describing managed futures funds as “black boxes” may be inaccurate (and rather unfair), but many institutions clearly continue to avoid the sector.

That is why we wanted to produce this educational paper. For AIMA, the managed futures industry is an essential constituency of our membership. Societe Generale Prime Services has a full-service multi-asset platform, and specialises in servicing CTA firms and is passionate about improving understanding of the sector. CTA trend-followers and other managed futures funds offer tremendous benefits to investors – and have done so for many, many years, not only in 2008.

This is not a marketing paper and we recognise that CTAs are not for everybody. There are always periods of underperformance, but collectively and on average, CTAs offer competitive risk-adjusted and non-correlated returns, and have historically demonstrated their ability to provide downside protection. We hope, with the help of this paper, that investors will be able to make better informed decisions about the sector.

-

Jack Inglis

CEO

-

Tom Wrobel

CAIA, Director, Alternative Investments Consulting, Societe Generale Prime Services

Executive summary

Structure: The paper opens with an overview of the commodity trading advisor (CTA) sector, highlighting the significant growth that has taken place in the managed futures industry in recent years and explaining how the managed futures strategies that CTAs employ work in practice. The breadth of sub-strategies under the managed futures umbrella are then examined. The third part of the paper examines the benefits and perceived risks to investors of allocating to managed futures strategies and also addresses various common misunderstandings about CTAs. The paper concludes by exploring the common ways as to how investors can access the various investment strategies that are available.

Sector characteristics: Managed futures is one of the key alternative investment strategies, accounting for approximately $340bn in total assets under management. Whilst the industry has become dominated by systematic trend following, there is an assortment of sub-investment strategies that are available, and they all have one thing in common – they seek to generate absolute returns through active trading in the global futures (and foreign exchange) markets. Most of the managed futures programs are systematic and quantitatively driven via mathematical models and computational power to help guide their trading decisions. Few are discretionary, although still make substantial use of quantitative analysis in their decision making process. The range of returns between the best and worst performing CTAs is comparatively large – making CTA selection all-important for investors.

Investor benefits: This paper shows that CTAs typically offer diversification benefits, dampen portfolio volatility and provide uncorrelated returns. Positive returns of course are not guaranteed, but CTAs are still often regarded by investors as “insurance” products, given their tendency to outperform during market falls and crises. Particularly noteworthy was their performance collectively in 2008, when all CTAs in the Societe Generale managed futures database reported positive returns and many were up by more than 30% for the year.

Performance characteristics: Managed futures strategies have demonstrated strong performance over long-term horizons, especially in comparison to traditional equity and bond markets. There have also been consistent asset flows into CTAs, particularly in recent history. As a result, the sector has grown significantly, increasing by more than nine fold since 2000. In a portfolio context CTAs can add significant value and diversification benefits for investors. For example the performance of a traditional asset mix of 60% bonds and 40% equities are enhanced with the addition of CTA strategies, which may increase the return and riskadjusted returns (by lowering the volatility), as well as considerably lowering and shortening drawdowns.

What are managed futures? Managed futures is one of the key alternative investment strategies. Whilst there are an assortment of subinvestment strategies within the universe of managed futures, they all have one thing in common – they seek to generate absolute returns through active trading in the global futures (and foreign exchange) markets. Most of the managed futures programs are systematic and quantitatively driven via mathematical models and computational power to help guide their trading decisions. Few are discretionary, although even these still make substantial use of quantitative analysis in their decision making process. The industry has become dominated by a type of systematic trading called trendfollowing, and this is generally the first port of call for new investors into managed futures strategy.

In the US, there is a regulatory term for organisations that provide advice for those specific markets/instruments, where they are known as Commodity Trading Advisors (CTA). Despite managed futures strategies having evolved significantly to incorporate financial markets and foreign exchange, in the industry the terms managed futures and “CTA”

are often used interchangeably and globally. For the purposes of this paper, we use the term CTA to describe an investment manager who runs a managed futures investment strategy.

Growth of the sector: The appeal of liquid, transparent and uncorrelated returns has been a significant factor in the growth of the managed futures sector. The significant increase in interest from institutional investors, increased open interest and liquidity in futures markets, and continuous improvement in information technology, have led to an uptick in the rate of growth over the last decade. Indeed, the sector has grown considerably over the past 35 years and continues to attract further investment. Since the year 2000 the total assets under management across managed futures strategies increased more than nine fold with the sector estimated to manage in excess of $340bn in assets as at the end of 2016 according to Barclayhedge1 (see for reference figure (1) below).

2016 also saw the strategy receive the highest level of capital investment (as measured by inflows) versus any other hedge fund strategy with approximately $17bn being invested. according to BarclayHedge. Notably, the appeal of the managed futures strategy rose in prominence arising from the events of the 2008 stock market crash. The positive performance of managed futures at that time in comparison to significant negative performance from other traditional risk asset classes created positive press and record capital inflows for managed futures for the following three years. The increased awareness of issues identified by studies in behavioural finance has also been a principal driver in the growth of the managed futures sector and other forms of investing which are led by quantitative analysis.

A number of these behavioural biases have been shown to affect the trading decisions of even knowledgeable and competent practitioners leading to more investors being persuaded to choose more systematic approaches when making an investment. Further support for the increased interest in managed futures strategies (and in particular systematic trend following strategies) points to a growing amount of research which opines that statistical-based algorithms may be able to predict the future pattern of price trends more accurately than human forecasters.

What do managed futures trade? As the name suggests, managed futures refers to the active trading of futures and forward contracts on financial and commodity markets. Futures contracts are a form of derivative product, that simply derive their value from an underlying asset. This could be something tangible such as a ton of cocoa or a bushel of wheat, or another financial point of reference, such as an equity index (e.g. S&P 500) or bonds and interest rates.

Futures transactions are regulated and the process is governed by an exchange, many of whom operate their own clearing houses guaranteeing the legal fulfilment of the futures contract. This reduces the risk that one of the parties fails to honour the terms of the contract, known as counterparty risk. Each counterparty is required to post collateral (in the form of a margin) against the positions being traded. It is for this reason that managed futures can gain access to a broad exposure of instruments at a fraction (margin) of their notional value.

A number of CTAs, (typically those with a currency strategy), can also trade forward contracts, historically in currency markets, but more recently in non-traditional markets, in order to gain access to the additional liquidity which exists in these markets. These are closely related to futures contracts, except that rather than being exchange-traded, they are agreements between two counterparties directly, and as a result do not have to follow a standardised format as they would do on an exchange. The level of margin that a trader has to pay to access a forward contract is set out in an ISDA Master Agreement.

Download full report

"Riding the Wave" is available to Members and Non-Members of AIMA. For more information about the report, contact AIMA's Head of Research, Tom Kehoe, at [email protected].